- You have Canadian citizenship, permanent resident status, refugee status or protected person status.

- You must be a Québec resident or be deemed to reside in Québec You must have been admitted to a recognized educational institution.

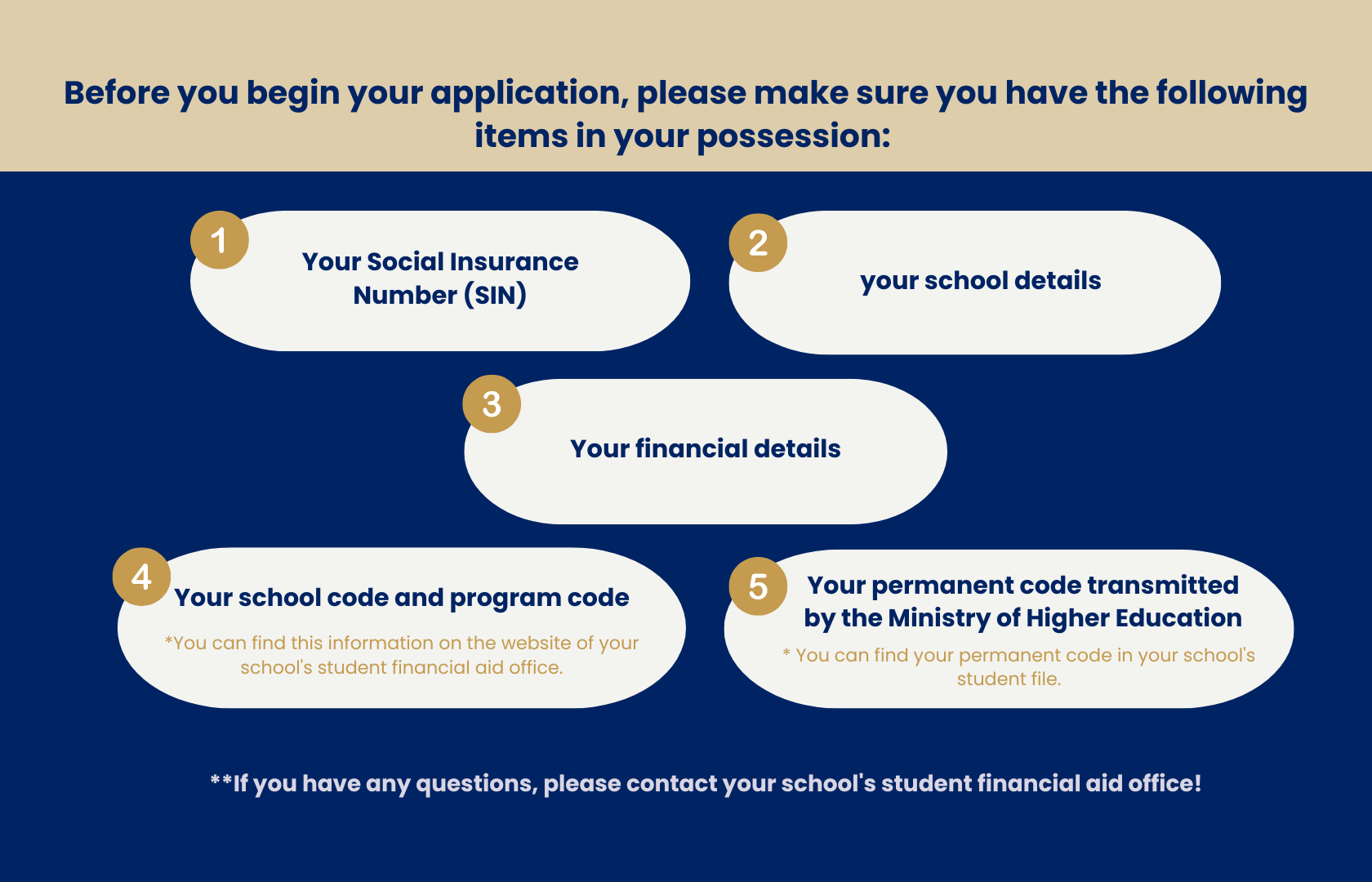

***To find out if your school and program are recognized, visit your school's student financial aid office.

- Be pursuing or be deemed to be pursuing full-time studies in a recognized program.

To validate your admission to the student financial assistance program, visit your school's student financial assistance office and/or the government's

student financial assistance website.

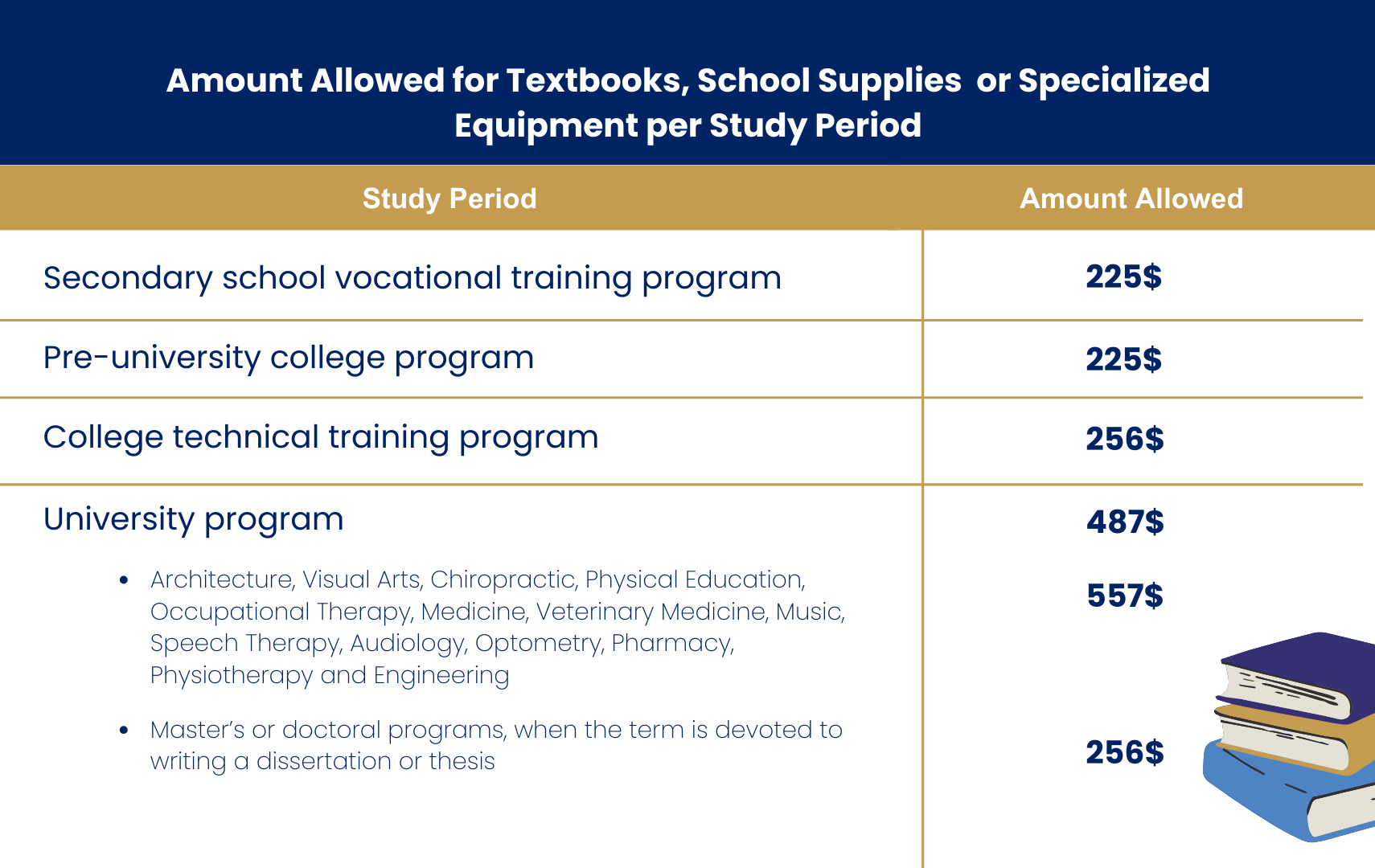

You can also simulate the amounts allowed via the government's

online calculator to see how much your loan and grant will be!